Blume Beacon: On SaaS pricing, the realities of VR, and circular economy

Blume Beacon is a collection of curated long reads from Blume's editorial desk

Welcome to another edition of Blume Beacon, where we deliver a curated list of tech content that informs the unknown and questions the known, right to your inbox.

This week, we have a mix of eloquent long reads and engaging perspectives that will catch your fancy. So what’s in store for this edition?

An illuminating deep-dive into the mysteries of the Price-Product Fit and how B2B SaaS founders can leverage pricing better to grow revenue.

Sajith Pai is back on his mission to find the best ways for a company to reach PMF with two thought-provoking interviews with founders.

Also worth noting: nine predictions that we have about the Apple headset launch and the VR industry and our thoughts on the circular economy. Let’s dive right in!

The Price-Product Fit: How SaaS Founders Can Drive Revenue with Their Pricing Strategy

What is that one question that keeps SaaS founders up at night? According to Blume’s Rohit Kaul, worrying about increasing the Annual Contract Value (ACV) remains their biggest night-time worry. Kaul believes that founders throw all types of spaghetti on the wall, from acquisition and retention to funnel optimization. in their bid to grow ACV. But pricing is usually lower in their pecking order. That’s where most founders err — an underpriced product creates a major business model problem when founders try to scale. They either hit a wall of poor unit economics or a much smaller market than they imagined when they raise prices.

In fact, the importance of pricing in growing revenue is widely documented. A study by subscription intelligence company Price Intelligently shows that tweaking price is 4X more efficient in improving revenue than customer acquisition and 2X more efficient than retention. But in many cases, pricing decisions tend to get obfuscated and overshadowed by other product-related decisions. This happens because new features are added to the product every month/quarter but prices aren’t changed at that frequency. And unlike product management, sales, and marketing, pricing has no functional owner in startups. Thus, there’s no forcing function to keep the organization focused on pricing decisions.

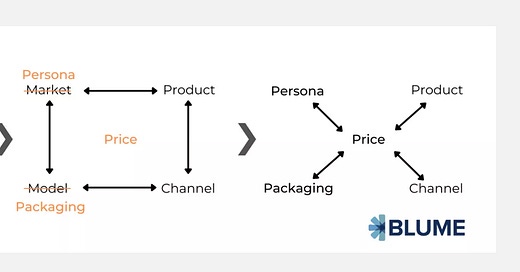

As per Kaul, to better index on pricing, founders should move it to the centre of decision-making. This means shifting the lens from product-market-model-channel fit to price-product-persona-packaging-channel fit. In this explainer — the first in the three-article series on B2B SaaS pricing — Kaul succinctly breaks down the reasons why he believes that pricing should lead to the product and the ways in which founders can ensure that the pricing strategy evolves with the product. Trust us; these pro tips are well worth your time. Read all about it here.

Apple of Our Eyes: Nine Predictions about the Apple Headset’s Impact on the VR Industry

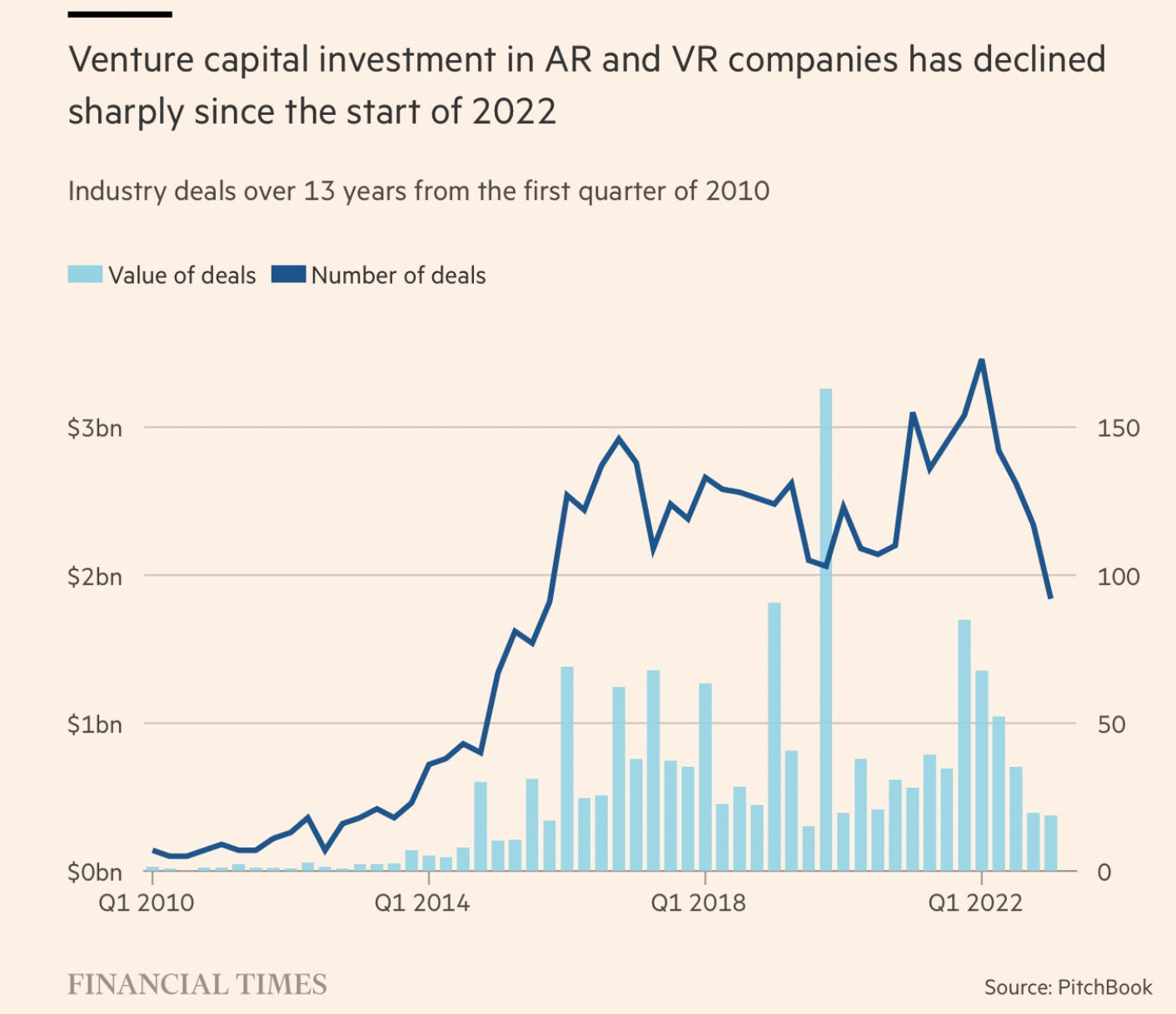

In its first major hardware launch for almost a decade, Apple unveiled Apple Vision Pro, its highly-anticipated augmented reality headset on June 5. From what we know, the headset, which has a two-hour battery life, is priced at $3499 and is set to release in the US early next year. Blume’s Joseph Sebastian and Swathi Dhamodaran have been deep into the trenches of AR and VR for over six months. Joseph leveraged this deep understanding of the AR/VR industry to crystal gaze and offer nine predictions about how the Apple Headset launch could impact the VR Industry, right before the launch of the Vision Pro headset.

While launching the Apple Vision Pro, Apple CEO Tim Cook said that the new headset “seamlessly blends the real world and the virtual world.” That’s something Sebastian, who has been tracking the space closely for the last six months, pointed out as well. He added, "Apple is likely to use a Mixed reality approach that will allow users to see the real world through the lenses of the headset, while also seeing virtual objects that are overlaid on top of the real world.” Find out the rest of his eight predictions here.

Continuing on the same trail of thought…

Fast Forward: The Next Big Thing is Here

It’s a known fact that the biggest prize in technology is reserved for those who are able to build the future. Every few years, a new platform is born, and the company that either builds it first or scales it most manages to accrue the most value. Over the years, it has been said that a platform reaches critical mass when it has 10 million devices in use. Even before Apple threw its hat in the ring, VR had crossed that threshold. In 2022, over 20 million VR headsets were sold. Blume’s Joseph Sebastian and Swathi Dhamodaran predict that VR is poised to revolutionize industries and India has a unique opportunity to make its mark in this rapidly evolving space. But how exactly can the country embrace this paradigm shift and realize the full potential of its technological capability? We’ve got you covered. Read the snippets of Blume’s XR thesis here.

Make PMF Great Again: In Conversation with Wakefit’s Chaitanya Ramalingegowda and Anshuman Bapna, founder of Terra.do

Remember Sajith Pai’s piece from our last newsletter? Well, it’s time we give you some background on his obsession with the topic. Over the years, Pai has always been puzzled by the lack of a practical guidebook on the topic that could benefit early-stage founders. So he decided to correct that gap and author a book on this seminal concept in the startup world. It’s time, he thinks, to make PMF great again, and to clarify it better. As part of the research for the said book, he is speaking to scores of founders to understand their perspective on PMF and related aspects. He believes that these illuminating conversations will be even more valuable for other founders and operators in the startup ecosystem struggling with the same questions. And so do we!

So here, we present interviews with two founders on PMF for your reading pleasure. First up is Chaitanya Ramalingegowda, co-founder of furniture + mattress e-retailer Wakefit. He speaks candidly about his two failed startups, strategies to ensure PMF, customer centricity of Wakefit, and early-stage marketing. Read the full conversation here.

Sajith Pai’s second conversation is with Anshuman Bapna, founder of climate tech startup Terra.do and erstwhile Mygola (acquired by MakeMyTrip) about the biggest mistakes founders can commit, the best metric to use at a consumer tech startup, and how he defines PMF. According to him, “PMF is not one S-Curve, it’s S-Curves stacked on top of each other.” That’s certainly some food for thought. Check out their entire conversation here.

Closing the Loop: Could the Circular Economy Lead to Sustainable Transformation?

Currently, India generates 1,60,000 tons of waste per day out of which only 30% is treated, and 30% of this is unaccounted for. Sure, at face value, the broad emissions due to “waste disposal” generated by the country are minuscule. But what about emissions generated by the extraction and generation of virgin materials produced to support the demands of a fast-growing nation? That brings Blume’s Venkatesh Modi to a pertinent subject often overlooked in the venture space: Circular Economy. This cradle-to-cradle model intends to reuse resources and reduce pressure on primary materials. Could a circular economy be the road toward sustainability? Let us break it down for you here.

Blumiers and Shakers: Deepika Jain’s Secret to Driving Community in Venture Capital

At Blume, we are huge believers in building new possibilities, whether that is reimagining a content-first VC website, creating intentional platforms and summits for learning and development, or even building a peer community between founders. But none of this would have been possible without our Community Team, which sits within our Platform function and helps accelerate portfolio performance by helping founders learn from peers and external experts.

But what exactly does a Community role entail in a VC firm? To answer that, Blume’s People and Culture Lead, Ria Shroff Desai speaks to Deepika Jain, who leads our Community function, about the changing definition of her role, the gaps in how people view Community and Platform roles, and what impact such roles can add to a VC fund. Read all about her journey here.

Ear On The Ground

At Blume, we love listening — to the advice that we get from investors, founders, readers, and even podcasts. You see, nuggets of wisdom can be found everywhere as long as you know where to look. So allow us to tell you a little about the podcasts that have been on our team’s radar last month. In the Invest Like The Best podcast, Fidji Simo, the CEO of Instacart, a San Francisco-based grocery delivery company speaks at length about the strategies her team adopted to create delightful customer experiences and how they differed from her experience leading the Facebook app. For instance, one of the ways Instacart leveraged sales was through their content, proving something that we at Blume steadfastly believe: a business which is utilitarian as well as inspirational is fundamentally more valuable.

Then there is this fascinating episode of John Jantsch’s marketing podcast where he breaks down how businesses can enhance marketing strategies with AI’s assistance. The founder of Duct Tape Marketing, a Colorado-based marketing services provider to businesses, Jantsch argues that AI is “informed automation,” an idea generator which means that it really supplements the work that we would typically do by hand. One of the keys to utilizing AI tools to garner efficient marketing strategies is to give it good prompts. Check out our full recommendations of podcasts here.

Look Back in Bangers (Revisiting Stories from the Past)

Remember Infollion’s SME IPO that we discussed in our last In Full Blume newsletter? We pointed out how our portfolio company didn’t just build frugally but more importantly, its CEO Gaurav Munjal put his head down and built it almost profitably throughout the last decade, finding repeat clients in the top-tier consulting and PE firms. The result? Infollion’s public issue was significantly oversubscribed.

That also makes it a perfect time to revisit our extensive primer on how Indian founders can build a publicly listed company. Studies have shown that the most valuable companies are built post-listing for years, if not decades, with over 90% of market cap creation in such companies getting built after the IPO. Who wouldn’t aspire to have such stories in their Venture Fund portfolios? In this three-part series, Blume’s Karthik Reddy surveys the state of IPOs, and the obstacles companies face while trying to list in India, and explains“the listing mindset,” a trait that any founder looking to build a lasting company should absolutely possess. Find part I of his analysis here; part II here; and part III here.